Two CEOs tell us where alternative lending is headed

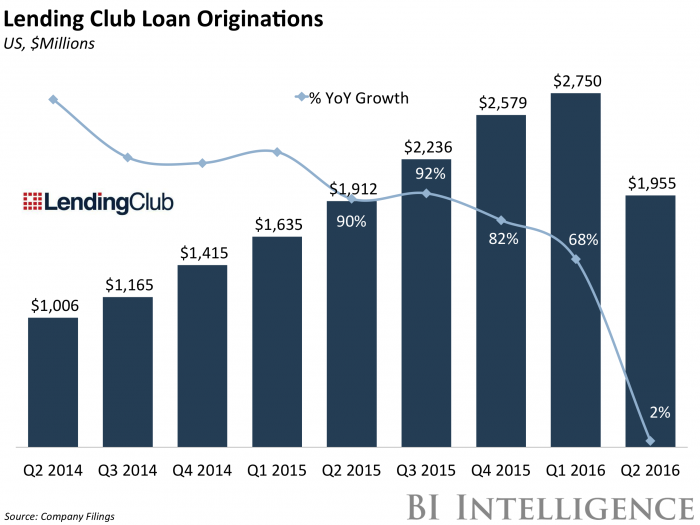

The alternative lending industry is hitting turbulence as it attempts to overcome its biggest challenge — securing capital for loans from investors as other assets become more competitive from a risk-return perspective.

We reached out to top brass from two alternative lenders to get more insight into how they’re grappling with this problem and where the industry is headed.

Rob Frohwein, CEO at Kabbage. Kabbage is a US-based small business and consumer lender. The company doesn’t offer a P2P lending marketplace like Lending Club; it originates and holds loans on its books rather than serving as an intermediary between borrowers and investors.

- Marketplace vs. balance sheet: Frohwein tells us that investors in marketplace lenders focus on the risk of investments as much as potential returns, but returns are subject to the actual default rate of the loans they invest in. In contrast, the return is fixed for note-holders in the balance sheet lending model. For this reason, balance sheet lenders have a more stable source of capital because investors know the return they’re going to get. “Marketplace appears to continue to struggle especially in the consumer market where margins are thin and alternatives are plenty,” says Frohwein.

- The outlook for alt lending: Frohwein says that alt lenders can be successful in both good and challenging economies, but that it’s critical firms do not assume past market behavior is indicative of the future. Alt lenders need to have multiple liquidity options in place, even if that means making a trade-off on their balance sheets to achieve such flexibility. “I can tell you the need for a diversified strategy is painfully obvious,” Frohwein explains. “And I don’t think we’ve seen everything yet. If a credit cycle does occur, those that don’t have reasonable margins in their business and adequate sources of capital will have serious challenges.”

Ron Suber, president at Prosper Marketplace. US-based Prosper offers a P2P marketplace for consumers and closely competes with Lending Club. Suber says that Prosper has no plans to pursue an on balance sheet model.

- Marketplace vs. balance sheet: Suber says that “there is no magic answer,” there are three models in the industry — on balance sheet only, marketplace only, and hybrid — and it’s not clear that one is better than the others. But Suber is confident in Prosper’s marketplace model. “We’ve found investors that have committed to us in the marketplace model and banks who love the ability to work with us in a nonbalance sheet format to get the yield and the risk that they require.”

- Industry outlook: Suber is more optimistic than Frohwein and suspects that the recent slew of bad news is behind the industry. “The insatiable quest for yield around the world is getting even stronger. So more and more pensions, endowments, foundations, and smart money is starting to find the platforms that are institutional, that have enterprise risk solutions, that support securitization.” But while Suber expects profitability to increase for the top platforms, he also expects that the industry will thin out.

Alternative lending is particularly important for small businesses, which represent 99% of US companies, 54% of total sales, and 55% of all jobs, according to the US Small Business Administration.

These businesses need capital in order to grow, but small businesses are underfunded — only half of small businesses with $100,000 to $1 million of annual revenue received at least some of the financing they applied for from large banks in late 2015. This is partially because banks have retreated from this segment because issuing loans to small businesses using the traditional underwriting model is expensive. This leaves a massive amount of unfulfilled loans that we estimate reached $96.5 billion in Q4 2015.

Alternative lending companies have stepped in to capitalize on the opportunity available in helping meet more small business’ lending needs. Alternative small business lending platforms use machine learning and digital tools to extend credit to a wide array of small businesses quickly and efficiently, particularly to those that have been rejected by banks. Alternative small business lending companies provide digital platforms that connect small business borrowers to capital using nontraditional means.

We estimate that alternative small business lenders originated $5 billion and had a 4.3% share of the small business lending market in the US in 2015. But alternative small business lending platforms will originate $52 billion and gain a 20.7% share of the total market by 2020, driven by the continued growth of new players, increased borrower awareness and interest, and most importantly, major partnerships with big banks.

Evan Bakker, research analyst for BI Intelligence, Business Insider’s premium research service, has compiled a detailed report on small business alternative lending that analyzes the market opportunity for alternative lenders, forecasts the market share and volume growth of alternative lending platforms, profiles key players, and addresses the main industry risks.

Here are some key takeaways from the report:

- Alternative lending platforms are in a position to capitalize on this underfunding and also take share from banks. These companies use machine learning and digital tools to extend credit to a wide array of small businesses quickly and efficiently. We estimate that alternative lending companies’ share of the small business lending market in the US will reach 20.7% by 2020.

- Alternative lenders are now partnering with banks and this will propel growth going forward. New lenders are finding opportunities to offer white-label services to major banks. We expect banking partnerships, like the one between JPMorgan and OnDeck, to add 7.7 percentage points to the alternative lending industry’s market share by 2020.

- A flurry of new lenders have entered the market, but it’s still early innings. A handful of small business lenders, from Funding Circle to Credibly, have entered the market and this is creating challenges as customer acquisition costs rise and alternative lending companies struggle to differentiate themselves.

Subscribe today to receive our latest News & Insights!

Receive our latest stories delivered monthly directly to your inbox.

Subscribe Now