Marketplace Lending in 2015 – A Year of Performance and Growth

2015 proved to be a big year for the marketplace lending industry. Unparalleled growth, as well as strong investment performance.

Growth

Arguably the biggest theme in marketplace lending in the past year proved to be the overall growth of the industry. From record setting volume to Wall Street’s participation, the P2P lending space remains in high-growth mode.

Lending Club’s 2014 IPO laid the ground work for increased visibility and interest in marketplace lending, and helped to establish the term by which the industry has become to be known. In 2014, US marketplace lending origination volume was around $5.5 billion. Today, we estimate 2015 origination volume could top $18 billion. Accounting firm Price Waterhouse Coopers expects marketplace lending loan volume to grow to $150 billion by 2025.

Below are some of the highlights and headlines from the past year:

- Prosper has surpassed $5 billion in loans originated through its platform since inception. Just a year previous they had only reached the $2 billion mark.

- Avant had raised $325 million in new equity funding at around a $2 billion valuation, from General Atlantic and J.P. Morgan, among others.

- Square, the San Francisco payments technology company, went public (NYSE: SQ) and raised $279 million (at a $5.5 billion fully-diluted valuation).

- SoFi, a San Francisco company who focuses mainly on student loan refinancing, announced that it has raised $1 billion in Series E funding led by SoftBank. The funding, which valued the company at around $4 billion, is said to be the largest-ever equity funding in the financial technology space.

- Wall Street is ramping up their participation in marketplace lending and helping to fuel the online lending industry – Citigroup marketed around $377 million of bonds backed by loans originated through Prosper.

Performance

The average net annual returns for investors who have invested their money through two of the largest marketplace lending platforms, Prosper and Lending Club, have ranged from 5% to 9%. As Ron Suber, president of Prosper Marketplace, recently stated in a CNBC article, “Demand from borrowers and investors, retail and institutional, remains at an all-time high. On a relative basis to the fixed-income market, Prosper’s loan performance is even stronger given the recent market volatility.”

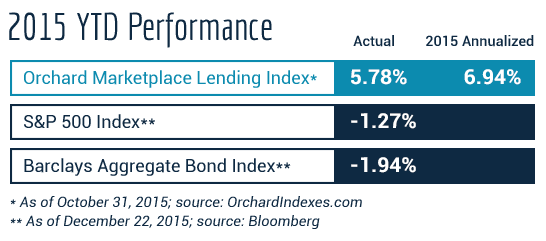

Investors have enjoyed consistent returns from marketplace lending, and which have out-paced stocks and bonds in 2015. As the table above shows, the Orchard US Consumer Marketplace Lending Index, an index that tracks the performance of the aggregate amount of loans to consumers originated and funded on eligible US-based online lending platforms, has outperformed the S&P500 stock market index as well as the Barclay’s Aggregate Bond Index in 2015.

If marketplace lending continues on the same trajectory as it has in 2015, investors and consumers alike should be excited to see what 2016 has to bring.

For more information on any of the above information or marketplace lending, contact Prime Meridian Capital Management.

Sources

http://www.morganstanley.com/ideas/p2p-marketplace-lending/?cid=sm_corp_twt_june_18_2015

http://thelendingmag.com/lending-club-stock/

https://www.orchardindexes.com

http://www.bloomberg.com/quote/SPX:IND

http://www.businessinsider.com/lending-club-ipo-sec-lockdown-2015-5

http://www.cnbc.com/2015/08/28/more-investors-turn-to-p2p-lenders-for-high-yield.html

Subscribe today to receive our latest News & Insights!

Receive our latest stories delivered monthly directly to your inbox.

Subscribe Now